By P.Parameswaran (AFP) – 21 hours ago

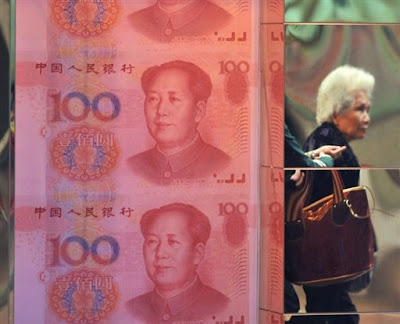

PITTSBURGH, Pennsylvania — China has called on the United States to ensure the stability of the weak US dollar, saying it was critical to global recovery driven by trade in the key reserve currency.

While showing apparent concern over the status of dollar, which dived to a year low against the euro on Wednesday, a Chinese central bank official said Beijing remained supportive of the dollar.

"Since US dollar is a major reserve currency and a major trade settlement currency, the stability of the US dollar has a key influence on the stability of the world economic recovery," said Xie Duo, director general of the People's Bank of China on the sidelines of the Group of 20 summit in Pittsburgh.

"We support the stability of major reserve currencies."

But Xie reminded the United States not to allow its "domestic policies" to damage the reputation of the greenback as an international reserve currency.

"The US government has to strike a balance between these two functions," he said.

Xie was answering a question on the impact of the embattled dollar on Chinese exports as well as its 800 billion dollar US Treasury bond holdings and more than two trillion dollars in dollar reserves.

Before Xie spoke, Treasury Secretary Timothy Geithner reaffirmed Washington's strong-dollar policy Thursday, saying: "A strong dollar is very important to the United States."

Underscoring Beijing's concern over the dollar's weakness, Xie said the Chinese central bank and other Chinese government agencies "are watching very closely where the US dollar is headed.

"We are also analyzing the causes of this and making our own assessment on the future exchange rate of the US dollar."

The dollar issue has become a subject of debate at the G20 as US President Barack Obama and other leaders of the forum consider a new framework for tackling the so called global "economic imbalances" blamed for fuelling the latest financial crisis.

Some argue that the latest financial crisis resulted from imbalances between savings and investment in major economies, which have led to large current deficits, as evident in the United States, and surpluses, as enjoyed by China.

Beijing was the first to call for a new global currency as an alternative to the US dollar as the US deficit rocketed -- the White House estimates it could reach nine trillion dollars over a decade.

Chinese Premier Wen Jiabao expressed concern as early as March over the safety of his country's massive US bond holdings that virtually made China the largest creditor to the United States.

Then, Chinese central bank governor Zhou Xiaochuan, who supervises more than two trillion dollars worth of dollar reserves, the world's largest, raised the stakes by calling for a new reserve currency in place of the dollar.

He wanted the new reserve unit to be based on the SDR, a "special drawing right" created by the International Monetary Fund, drawing immediate support from Russia, Brazil and several other nations.

"These countries realize that they would suffer losses if inflation eroded the value of the dollar securities they own," said Richard Cooper, a professor of international economics at Harvard University.

But he said there were no feasible alternatives to the US dollar as a widely used international currency, discounting even IMF's synthetic SDR currency, comprising a basket of the dollar, euro, yen and the pound.

"The dollar will remain the dominant world currency, thanks to the stability of our political system and the rule of law that isn't a feature of many other economies," said Irwin Stelzer, director of economic-policy studies at the Washington-based Hudson Institute.

skip to main |

skip to sidebar

Lingerie Fashion

Show 2011-2012

Lingerie Fashion

Show 2011-2012

Lingerie Fashion

Show 2011-2012

Lingerie Fashion

Show 2011-2012

Blogger news

Blogroll

Categories

- 2010 (2)

- AFP (3)

- Angkor Borei News (2)

- Angkor Wat complex (3)

- ASEAN (15)

- ASEM 8 - Brussels 2010 (1)

- Asia (13)

- B B C (5)

- Bangkok Post (26)

- Business-Economic (318)

- Cambodia (421)

- Cambodia Water festival (3)

- Cambodia Water festival 2010 (44)

- Cambodian border (1)

- Cambodian culture (9)

- Cambodian military tests rockets (2)

- Canada (1)

- DAP News (1)

- Economics Cambodia (1)

- Environment (3)

- Etertainment (37)

- Everyday.com.kh (1)

- health (8)

- Khmer Krom (5)

- Khmer M'chas Srok (1)

- Khmer Poem (49)

- Khmer Rouge (6)

- Khmer Smot (2)

- Khmerization (1)

- Koh Kong (1)

- language (1)

- Long Beach Press Telegram (1)

- Los Angeles Times (1)

- Mekong River (4)

- MIB (1)

- New York Post (1)

- News (150)

- November 20 (1)

- Phnom Penh City (1)

- Phnom Penh Post (11)

- Pictures of the Day (1)

- Politics (1)

- Prasat Ta Moan (1)

- Preah Vihear temple (50)

- Quebec (1)

- Sacrava's Political Cartoon: (14)

- Sam Rainsy' (2)

- Sam Rainsy's letter (1)

- Science - Technology (112)

- Special Report (3)

- Sport News (11)

- Ta Moan Thom and Ta Moan Toch (1)

- Temple of Preah Vihear UNESCO (4)

- Thai inteview on Preah Vihea (1)

- Thailand (50)

- The Nation (6)

- The New York Times (2)

- Theary Seng (3)

- Things to See at Night in Phnom Penh (1)

- Top Stories (64)

- USA (3)

- Vietnam Net (1)

- VOA Khmer (29)

- Water Festival (1)

- World News (556)

- Xinhua (23)

My Blog List

Followers

About

Popular Posts

-

Last Chance to Secure Rare Piece of Tropical Paradise 5 October 2010 ( Phuket News ) – Cambodia’s first luxury private island resort...

-

via CAAI 13 Thai community radio stations ordered closed, 3 media workers arrested, for airing lese majeste speech Wednesday, 27 Apri...

-

Tang Chhin Sothy/Getty Images The aftermath of a stampede near a bridge in Phnom Penh, Cambodia on Saturday after millions cele...

-

This is a carving on the Ta Prohm Temple, Siem Reap, Cambodia. Is this dinosaur (stegosaurus) or a rhinoceros? I think it is a stego...

-

A contestants takes part in the World Strip Poker Championships on August 19, 2006 in London. 195 contestants took part in the first champ...

-

A diner eats her meal at a toilet-themed restaurant on October 24, 2006 in Shenzhen of Guangdong Province, China. Food arrives in bowls sh...

-

A woman walks past signs on a retail street in Beijing. China’s economy expanded at an annualized rate of 9.5% in the second quarter, slight...

-

Chinese models pose in front of a plane of the August 1st military aerobatic squadron on November 1, 2004 at the Airshow China 2004 in Zhu...

-

http://greenanswers.com/ via CAAI By Ramon Ho on Mon, 05/09/2011 In Northern Cambodia, a group of Buddhist monks have made plans to ...

Blog Archive

-

►

2011

(258)

- ► 07/17 - 07/24 (6)

- ► 07/10 - 07/17 (3)

- ► 07/03 - 07/10 (3)

- ► 06/26 - 07/03 (17)

- ► 06/19 - 06/26 (16)

- ► 06/12 - 06/19 (12)

- ► 06/05 - 06/12 (5)

- ► 05/29 - 06/05 (14)

- ► 05/22 - 05/29 (21)

- ► 05/15 - 05/22 (3)

- ► 05/08 - 05/15 (20)

- ► 05/01 - 05/08 (12)

- ► 04/24 - 05/01 (63)

- ► 04/17 - 04/24 (11)

- ► 04/10 - 04/17 (1)

- ► 04/03 - 04/10 (1)

- ► 03/27 - 04/03 (10)

- ► 03/20 - 03/27 (2)

- ► 03/13 - 03/20 (5)

- ► 03/06 - 03/13 (2)

- ► 02/06 - 02/13 (14)

- ► 01/30 - 02/06 (8)

- ► 01/23 - 01/30 (9)

-

►

2010

(663)

- ► 11/28 - 12/05 (9)

- ► 11/21 - 11/28 (45)

- ► 11/14 - 11/21 (1)

- ► 10/24 - 10/31 (8)

- ► 10/03 - 10/10 (12)

- ► 09/19 - 09/26 (26)

- ► 09/12 - 09/19 (43)

- ► 09/05 - 09/12 (57)

- ► 08/29 - 09/05 (22)

- ► 08/22 - 08/29 (45)

- ► 08/15 - 08/22 (64)

- ► 08/08 - 08/15 (55)

- ► 08/01 - 08/08 (40)

- ► 07/25 - 08/01 (44)

- ► 07/18 - 07/25 (6)

- ► 07/11 - 07/18 (19)

- ► 07/04 - 07/11 (5)

- ► 06/27 - 07/04 (16)

- ► 06/13 - 06/20 (9)

- ► 05/30 - 06/06 (8)

- ► 05/23 - 05/30 (14)

- ► 05/16 - 05/23 (12)

- ► 05/09 - 05/16 (8)

- ► 05/02 - 05/09 (23)

- ► 04/25 - 05/02 (14)

- ► 04/18 - 04/25 (9)

- ► 04/11 - 04/18 (3)

- ► 04/04 - 04/11 (3)

- ► 03/14 - 03/21 (3)

- ► 03/07 - 03/14 (10)

- ► 02/28 - 03/07 (30)

-

▼

2009

(647)

- ► 12/06 - 12/13 (5)

- ► 11/08 - 11/15 (6)

- ► 11/01 - 11/08 (3)

- ► 10/25 - 11/01 (19)

- ► 10/18 - 10/25 (45)

- ► 10/11 - 10/18 (11)

- ► 10/04 - 10/11 (88)

- ► 09/27 - 10/04 (11)

-

▼

09/20 - 09/27

(111)

- IMF raises 2010 global growth forecast to 3%

- Change in Subscription Accounting Rules to Benefit...

- QUOTES & ADVANCED CHARTING Get real-time market in...

- Crawford says Time Warner will sell magazine unit

- No injuries, evacuations from refinery fire in LA

- A Fifth UBS Client Pleads Guilty in Tax Case

- U.S. steps up prosecution of tax evaders

- Stock futures steady ahead of jobs, housing data

- G20 to police new world economic order

- Man charged with conspiracy in US terrorism invest...

- Obama Says 'Iran on Notice' in Nuclear Standoff

- Gold Stabilises Following Thursday’s Sharp Fall

- Review: Surrogates Returns Bruce Willis to Smart-G...

- Actor Randy Quaid freed on bail

- Record-breaking baby

- Massive police presence in Pittsburgh takes fight ...

- Water On Moon: NASA Hails ISRO

- Gunshots disrupt Gaza funeral

- Canada to host 'transition' summit in 2010

- Where will banks make up lost overdraft fees?

- Obama issues ultimatum to Iran on nukes

- Air Force restarts $35B tanker competition

- Bank of America rejects SEC claims in bonus suit

- New Jersey man pleads guilty for hiding UBS account

- Back to Google News Yen climbs after Japan ministe...

- Stability of US dollar key to global recovery: China

- Forbes.com Video Network Markets

- G20: Banks to be forced to double capital levels

- King of Pop offers praise for Princess Diana, Adol...

- Reports on manufacturing, housing weigh on stocks

- Latest Data Show Volatile Economy Took a Few Steps...

- American, United add $10 surcharge on 3 busy days

- Hyatt says fired Boston workers offered new jobs

- Sony Kills Plans for UMD Trade-in Program for PSP Go

- Missile-tracking satellites launched on demo flight

- Missile Launch

- Iran defiant amid new nuclear plant row

- FOREX-Dollar slumps to 1-yr lows before Fed, kiwi ...

- Reversal of Fortunes: Banks Bailing Out the Govern...

- Fed remains in stimulus mode but eyes exit strategy

- Halifax cuts overdrawn account fees

- Top US Bank Seeks to Pay Back Federal Aid

- Carnival profit falls 20 pct but beats Wall Street

- HSBC bids farewell to dollar supremacy

- Dow, S&P slip as Nasdaq climbs

- FDIC may borrow from banks to top up fund Read mo...

- ITN Last update: Tue Sep 22 2009 07:51:39 Latest...

- Zune HD Review: Music discovery at its finest

- SolarCity Announces Sun-Powered EV Fast-Charging S...

- Paul Otellini Opens IDF 2009

- Obama Set to Host Three-Way Mideast Talks

- Analysis: the flaws in General McChrystal's strategy

- * Share this on: Mixx Facebook Twitter...

- Obama Turns Serious on Letterman

- If Governments Aren't Safe, Are We?

- K Alliance Prepares for Microsoft Windows 7 Release

- Asian markets end lower, but Shanghai outperforms

- BofA to face SEC trial, exits loss-sharing deal

- Leading Economic Indicators Rise in August

- Gold hits 1-week low on dollar, flirts with $1,000

- Dell to acquire Perot for $3.9bn

- BofA skips Congress deadline, faces new SEC threat

- Forex-Dollar tentatively higher, sterling depressed

- Dow, S&P hit by commodities; Nasdaq up on biotech

- Much Debate But Little Drama Expected at Fed

- [Rumour] Microsoft to launch two iPhone competitor...

- US Proposes New Network Neutrality Rules

- Obama Takes Media to Task for Coverage of Racial C...

- Fending Off Failure in Afghanistan

- Stock futures signal dip; Palm in focus

- Sterling was ripe for a fall, says Bank of England...

- Easy-Money Fed Fueling U.S. Dollar “Carry Trades”

- Lufthansa likely to cut administrative jobs at its...

- Forget Pluto, NASA probe finds darkest parts of mo...

- Fla.-bound space shuttle Discovery stops in Texas

- Obama faces battle with Pentagon hawks to achieve ...

- AT&T Tilt 2 (Touch Pro 2) coming on Oct. 18th?

- AT&T to launch the Tilt 2 on October 18th? [UPDATED]

- McChrystal: 'Failure' Without More U.S. Forces in ...

- Is Microsoft Pushing the Zune HD Towards Yet Anoth...

- The Information: Google Bookworms

- 5 INTERNATIONAL SPACE STATION AMENITIES

- Buzz Lightyear Goes to Infinity… And Back!

- * Home * Business * Hardware * Softwar...

- Space shuttle Discovery begins flight to Florida

- Number of failed US banks hits 94

- Barack Obama changes American missile plans in Eur...

- Obama Sees Signs Economy to Grow While Unemploymen...

- Asda cuts fuel prices, starting fuel price war

- Job-cut figures in May strengthen signs of easing ...

- Pandit comments on Andrew Hall’s $100 million annu...

- Apple's Snow Leopard gets a Third-Party OpenCL GCD...

- Promises, promises

- Sony Ericsson C903 [Review]

- Real-Time Top 40: What Twitter Users Are Listening...

- Climate activists dump manure on Jeremy Clarkson's...

- Geithner ends money market guarantee program

- Google unveils new DoubleClick exchange

- Google Says Apple Flatly Rejected Voice App for iP...

- Facebook accounts hacked for $100

- ► 09/13 - 09/20 (112)

- ► 09/06 - 09/13 (48)

- ► 08/09 - 08/16 (10)

- ► 08/02 - 08/09 (2)

- ► 07/26 - 08/02 (36)

- ► 07/19 - 07/26 (17)

- ► 07/12 - 07/19 (21)

- ► 07/05 - 07/12 (14)

- ► 06/28 - 07/05 (47)

- ► 06/21 - 06/28 (41)

Copyright © 2011 Generalkh.blogspot.com | Powered by Blogger

Design by Free WordPress Themes | Bloggerized by Lasantha - Premium Blogger Themes | JCPenney Coupons

0 comments:

Post a Comment