By MARTIN CRUTSINGER (AP) – 4 hours ago

WASHINGTON — Flat incomes suggest more weakness ahead in consumer spending, reinforcing concerns about a ho-hum holiday shopping season and a sluggish economic recovery.

"This recovery is going to be very weak. Consumers are in no position or mood to spend. Their wages are down and they can't get credit," said Sung Won Sohn, an economics professor at California State University's Smith School of Business.

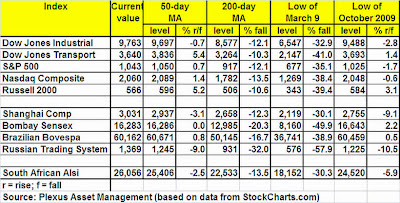

Concerns about the economy sparked by disappointing government data on spending and incomes sent stocks down Friday, erasing the previous day's big gains. The Dow Jones industrial average lost about 250 points, and broader indexes also fell.

The Commerce Department reported that personal incomes were stagnant in September while the all-important wage and salary category dropped 0.2 percent, as unemployment rose.

Consumer spending — which accounts for 70 percent of total economic activity — dropped 0.5 percent, the first decline in five months and the biggest since December.

The spending retreat reflected a sharp falloff in auto sales following a spike in August from the government's Cash for Clunkers program.

The overall economy, as measured by the gross domestic product, actually grew at a 3.5 percent rate from July through September, signaling an end to the longest recession since the 1930s.

But analysts said the income and spending report underscored fears about a weak recovery. The most pessimistic worry the nation could be headed for a double-dip recession as consumers, concerned about further job losses and their tattered investment holdings, refrain from spending.

Some analysts believe that GDP growth, which received a big boost from the government's stimulus programs in the third quarter, will slow to 2 percent or less in the current quarter.

David Wyss, chief economist at Standard & Poor's in New York, said a recent spike in energy prices and other problems will depress sales in coming weeks, giving the nation's retailers another lackluster shopping season.

Gasoline prices have risen for 17 straight days to a new high for this year of $2.695 per gallon, according to auto club AAA. The increase will add about $50 a month to the typical customer's gas bill, meaning less to spend at stores during the holidays.

Sliding incomes and rising energy costs further darken the outlook for consumer spending during the holidays. People who do spend will stick to discounters like Wal-Mart Stores Inc. and Target Corp., and continue shying away from big-name department stores like Macy's, said John Lonski, chief economist of Moody's Capital Markets Group. Price will be key again this year.

"It most definitely limits the upside for consumer spending and scares the wits out of retailers," Lonski said, adding that consumers are "going to spend as though the economy is still in a recession."

"If you don't make it, you can't spend it, especially with the access to credit much reduced," he said.

A second report Friday showed that wages and benefits including health care rose just 1.5 percent for the 12 months ending in September. That's the smallest increase for the Labor Department's Employment Cost Index on records that date to 1982.

The Obama administration also released a new report that said about 650,000 jobs had been saved or created under the government's $787 billion economic stimulus program. Congress is currently debating expanding certain elements of that program including unemployment benefits and the first-time homebuyers tax credit. Many private economists said the new income and spending report showed the need to do that.

Unemployment, currently at a 26-year high of 9.8 percent, will edge up to 9.9 percent when the government releases the October jobless report next week and will peak at 10.5 percent in the middle of next year, Wyss said.

Last month's spending drop resulted in a boost in the savings rate to 3.3 percent of after-tax incomes, from 2.8 percent in August. Many analysts believe households will keep striving to increase savings and replenish nest eggs that were crushed by last year's stock market crash. That also would hold back spending in the months ahead, weakening the recovery.

But inflation remains in check. An inflation gauge tied to consumer spending edged up just 0.1 percent in September, after a 0.3 percent August rise. Excluding food and energy, the gauge rose 1.3 percent over the past year, well within the Federal Reserve's comfort zone.

Fed officials meet next week and economists believe they will again keep a key interest rate at a record low.

AP Economics Writer Christopher S. Rugaber in Washington, AP Retail Writer Emily Fredrix in Milwaukee and AP Energy Writer Mark Williams contributed to this report.

WASHINGTON — Flat incomes suggest more weakness ahead in consumer spending, reinforcing concerns about a ho-hum holiday shopping season and a sluggish economic recovery.

"This recovery is going to be very weak. Consumers are in no position or mood to spend. Their wages are down and they can't get credit," said Sung Won Sohn, an economics professor at California State University's Smith School of Business.

Concerns about the economy sparked by disappointing government data on spending and incomes sent stocks down Friday, erasing the previous day's big gains. The Dow Jones industrial average lost about 250 points, and broader indexes also fell.

The Commerce Department reported that personal incomes were stagnant in September while the all-important wage and salary category dropped 0.2 percent, as unemployment rose.

Consumer spending — which accounts for 70 percent of total economic activity — dropped 0.5 percent, the first decline in five months and the biggest since December.

The spending retreat reflected a sharp falloff in auto sales following a spike in August from the government's Cash for Clunkers program.

The overall economy, as measured by the gross domestic product, actually grew at a 3.5 percent rate from July through September, signaling an end to the longest recession since the 1930s.

But analysts said the income and spending report underscored fears about a weak recovery. The most pessimistic worry the nation could be headed for a double-dip recession as consumers, concerned about further job losses and their tattered investment holdings, refrain from spending.

Some analysts believe that GDP growth, which received a big boost from the government's stimulus programs in the third quarter, will slow to 2 percent or less in the current quarter.

David Wyss, chief economist at Standard & Poor's in New York, said a recent spike in energy prices and other problems will depress sales in coming weeks, giving the nation's retailers another lackluster shopping season.

Gasoline prices have risen for 17 straight days to a new high for this year of $2.695 per gallon, according to auto club AAA. The increase will add about $50 a month to the typical customer's gas bill, meaning less to spend at stores during the holidays.

Sliding incomes and rising energy costs further darken the outlook for consumer spending during the holidays. People who do spend will stick to discounters like Wal-Mart Stores Inc. and Target Corp., and continue shying away from big-name department stores like Macy's, said John Lonski, chief economist of Moody's Capital Markets Group. Price will be key again this year.

"It most definitely limits the upside for consumer spending and scares the wits out of retailers," Lonski said, adding that consumers are "going to spend as though the economy is still in a recession."

"If you don't make it, you can't spend it, especially with the access to credit much reduced," he said.

A second report Friday showed that wages and benefits including health care rose just 1.5 percent for the 12 months ending in September. That's the smallest increase for the Labor Department's Employment Cost Index on records that date to 1982.

The Obama administration also released a new report that said about 650,000 jobs had been saved or created under the government's $787 billion economic stimulus program. Congress is currently debating expanding certain elements of that program including unemployment benefits and the first-time homebuyers tax credit. Many private economists said the new income and spending report showed the need to do that.

Unemployment, currently at a 26-year high of 9.8 percent, will edge up to 9.9 percent when the government releases the October jobless report next week and will peak at 10.5 percent in the middle of next year, Wyss said.

Last month's spending drop resulted in a boost in the savings rate to 3.3 percent of after-tax incomes, from 2.8 percent in August. Many analysts believe households will keep striving to increase savings and replenish nest eggs that were crushed by last year's stock market crash. That also would hold back spending in the months ahead, weakening the recovery.

But inflation remains in check. An inflation gauge tied to consumer spending edged up just 0.1 percent in September, after a 0.3 percent August rise. Excluding food and energy, the gauge rose 1.3 percent over the past year, well within the Federal Reserve's comfort zone.

Fed officials meet next week and economists believe they will again keep a key interest rate at a record low.

AP Economics Writer Christopher S. Rugaber in Washington, AP Retail Writer Emily Fredrix in Milwaukee and AP Energy Writer Mark Williams contributed to this report.